Swiss Risk Advisors Ltd

Services

Swiss Risk Advisors provides quantitative enterprise risk management services at two different levels.

At individual risk level

At risk portfolio level

Services

At individual risk level

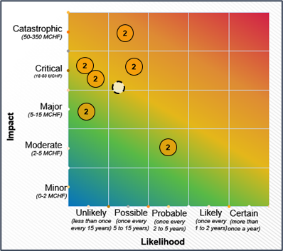

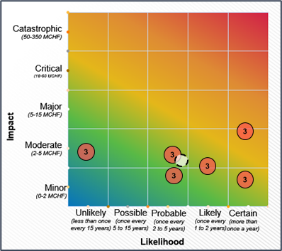

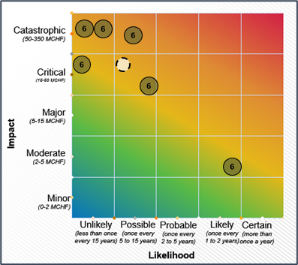

Usually, risk evaluation relies on a group of internal experts assessing several risks in a row. The results are often confusing as the individual evaluations are frequently spread over the whole risk map. Hence, for some experts urgent action is needed and for others no action at all is required.

The situation is puzzling, and no one is able to assert who is right. In many cases, for lack of a better option, the average position is retained. The results of a risk evaluation workshops look like what can be achieved by a blindfolded monkeys throwing darts at a dartboard. As for a monkey playing darts, luck, bad luck, subjectivity and biases play a predominant role in the outcome.

Further, that kind of evaluations are prone to intrumentalisation, i.e. an artificial increase of risk criticality (for example to get funds) or conversely a decrease of risk criticality (for example to hide nasty risks).

This neither helps nor supports risk-based decision-making which is the central expectation from any risk management framework.

A new approach is needed

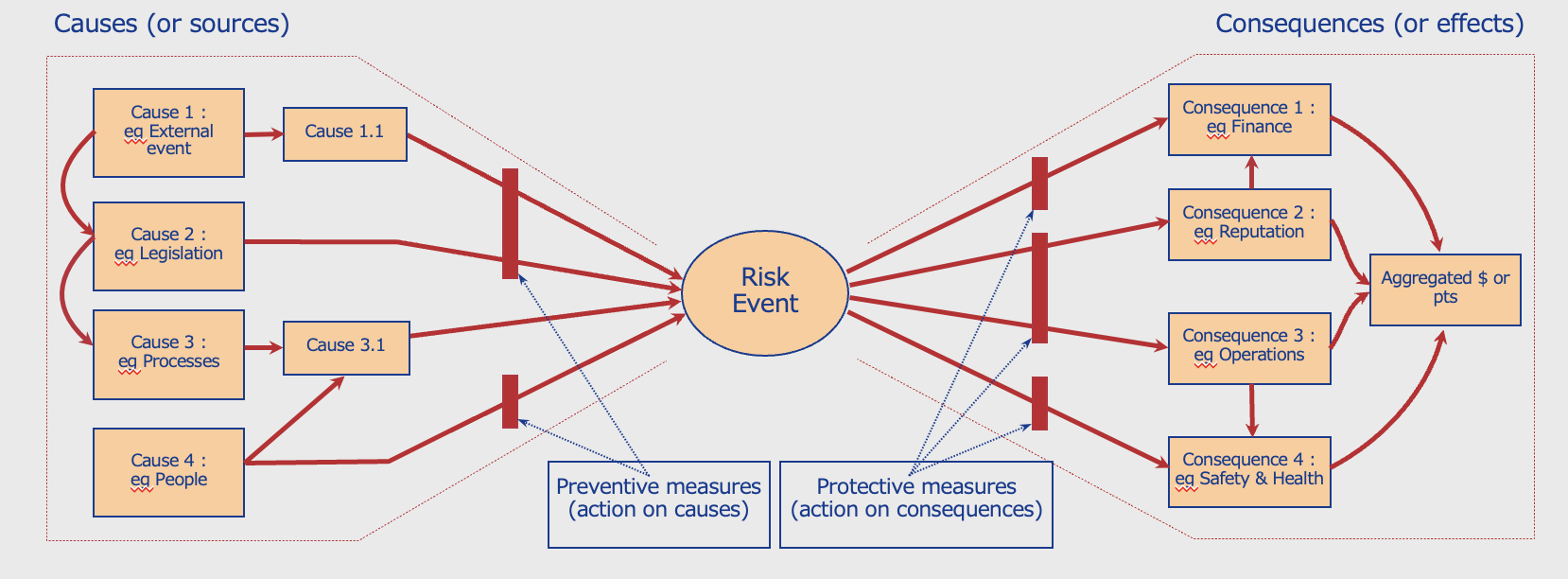

Swiss Risk Advisors help you to implement this innovative approach based firstly on isolating and assessing causes and consequences separately and secondly on a sensible combination of qualitative expert assessments and quantitative methods.

The approach is based on Bayesian Networks and allows to generate for each risk a full probability distribution (instead of a single evaluation). The results are more reliable and support better decision-making. It directly helps to decide investing (or not) in mitigation actions and, if yes, which ones are the most effective based on a per-action cost-benefit analysis.

Services

At risk portfolio level

Once risks have being individually assessed, they are gathered, first at unit level (e.g. division or department) and then at corporate level. They are collected in a “container” which is commonly referred to as a portfolio. This involves some form of evaluation based in many cases on probability and impact.

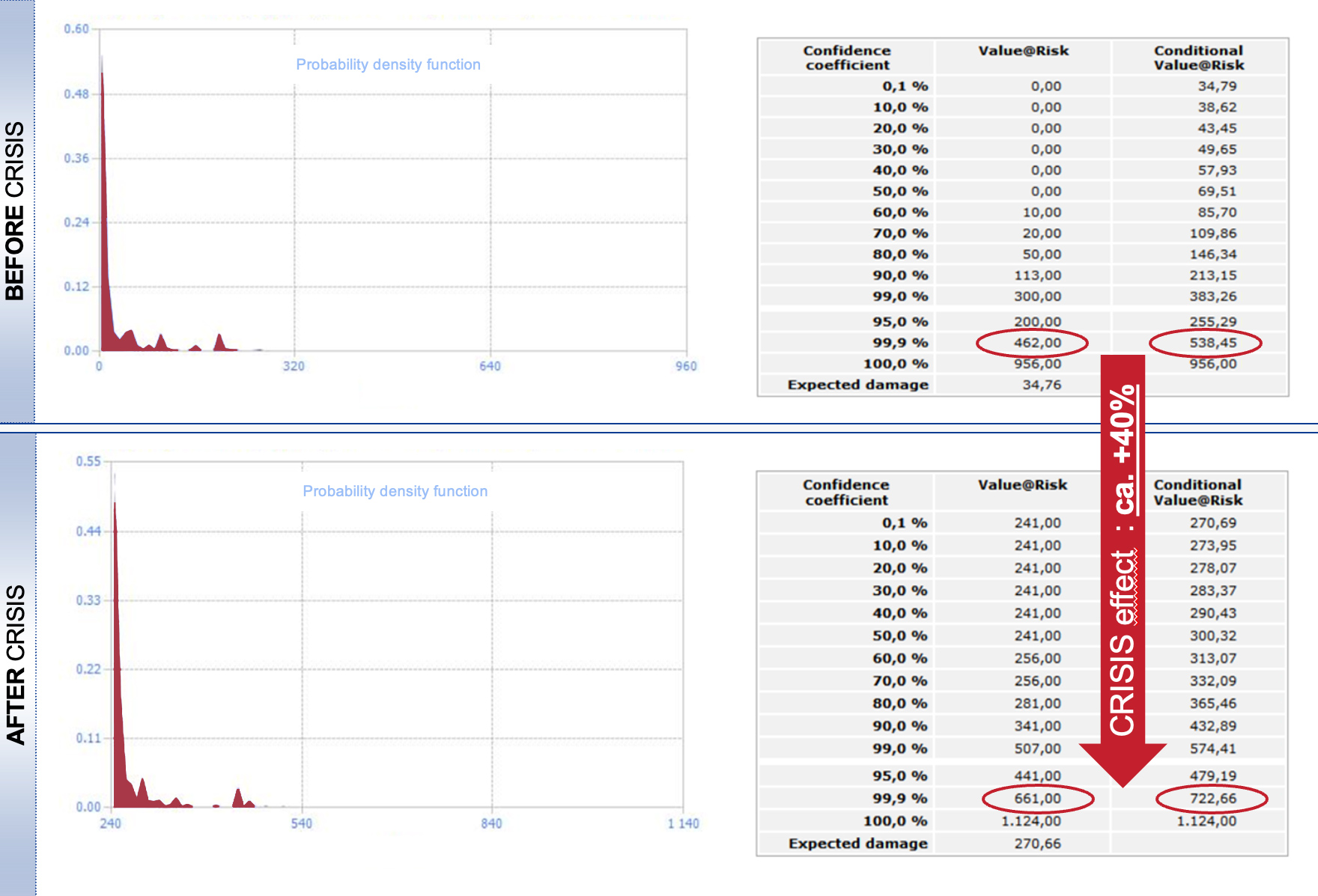

Overall impact of CRISIS on corporate risk portfolio

Tornado chart with most important risk portfolios

The quantitative approach to risk management at portfolio level allows to identify portfolios where risks are most important and deserve management attention.

Swiss risk Advisors allows you to develop key indicators to identify relevant risk portfolios in your company. Indicators are based on results of Monte-Carlo simulations. This allows you to invest your time and money in an efficient manner on portfolios deserving immediate attention. The key indicators also allow you to track the evolution of your risk portfolios over time, be it at corporate or at unit level. Targeted and efficient measures (high-ROI measures) can be implemented where it is most sensible. This directly contributes to the achievement of your strategic and operational objectives.